Recovery Loan Scheme | RLS has been Extended | Apply Now 247businessfinance

Are you finding it difficult to get business loans in the UK and looking for an alternative? We’ve got a solution for you. Consider borrowing money from the top lenders under the recovery loan scheme and get funded up to £2 million. Sounds great? So, continue reading to get to know what a recovery loan scheme is and how you can apply for a maximum amount of money to invest and grow.

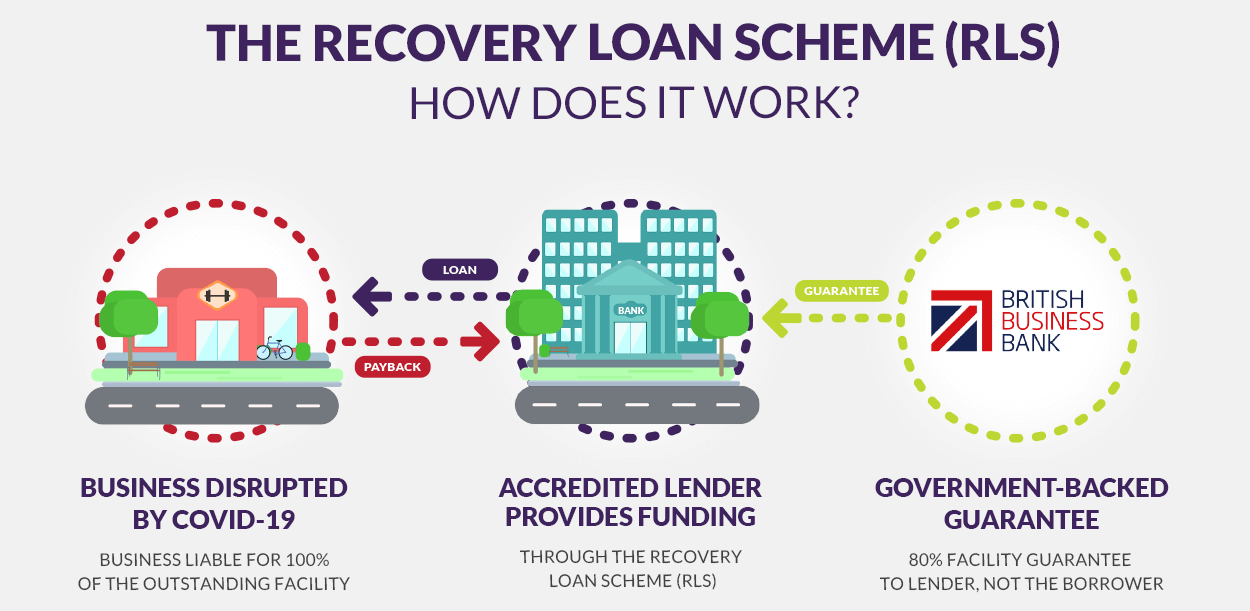

Recovery Loan Scheme:

The new Recovery Loan Scheme (RLS) is designed to aid UK companies in obtaining financing as they seek to expand and engage. For borrowers who are not covered by the Northern Ireland Protocol, it will support loan sums of up to £2 million. Unless they operate in a sector where aid limitations are relaxed, in that case, the maximum that can be borrowed is subject to a lower cap, borrowers in Northern Ireland may borrow up to £1 million. To have a clearer idea about the borrowing amount take note of the following points:

- Businesses outside the scope of the Northern Ireland Protocol can borrow up to £ 2 million.

- Borrowers in the scope of the Northern Ireland Protocol may borrow up to £ 1 million.

- If your business lies within the scope of the Northern Ireland Protocol and operates in a sector where aid limits are reduced like agriculture, fisheries/aquaculture, and road freight haulage – in this case, the maximum that can be borrowed is subject to a lower cap. Such as:

- £110,000 for businesses in the agriculture sector;

- £170,000 for businesses in the aquaculture and fisheries sector;

- £570,000 for businesses in the road haulage sector; and

- £1 million for businesses in all other sectors.

- Minimum loan amount, starting at £1,000 for asset and invoice finance, and £25,001 for term loans and overdrafts.

Financial Products and Use of Loan Amount:

Recovery Loan Scheme supports term loans, overdrafts, asset finance and invoice finance facilities. The type of financial products depends upon the lender too. Some lenders don’t offer all of the financial products mentioned above (meaning it varies from lender to lender). There is no restriction on using the loan amount. It can be used for any sort of business operation.

Eligibility Criteria:

Turnover limit: The scheme is open to smaller businesses with a turnover of up to £45m.

UK-based: The borrower must be carrying out trading activity in the UK and, for most businesses, generating more than 50% of its income from trading activity.

No Covid-19 impact test required: Unlike the previous iteration of the scheme, for most borrowers, there is no requirement to confirm they have been affected by Covid-19.

Viability test: The lender will consider that the borrower has a viable business proposition but may disregard (at its discretion) any concerns over its short-to-medium-term business performance due to the uncertainty and impact of Covid-19.

Business in difficulty: The borrower must not be a business in difficulty, including not being in relevant insolvency proceedings.

Subsidy limits: Borrowers will need to provide written confirmation that receipt of the RLS facility will not mean that the business exceeds the maximum amount of subsidy they are allowed to receive. All borrowers in receipt of a subsidy from a publicly funded programme should be provided with a written statement, confirming the level and type of aid received.

Start-ups: For early-stage businesses in their first three years of trading, the British Business Bank’s Start Up Loans programme (loans from £500 to £25,000 at an interest of 6% per annum) may be more suitable.

Exporters: Exporters are eligible for the scheme provided the facility will not be used to:

- Run an advertising campaign outside the UK

- Manufacture a product which is only available to customers in a market outside the UK

- Establish a representative office outside the UK or appoint an agent outside the UK

- Set up or operate a distribution network outside the UK, or

- Fulfil a direct export order.

- Your business will need to self-certify that you will not use RLS for these purposes.

Enterprise Investment Scheme EIS: If your business has received funding through EIS, you are eligible, provided that you satisfy the other RLS eligibility criteria.

According to the recovery loan scheme, there are a number of businesses who are eligible for this scheme but public sector businesses cannot qualify for the recovery loan scheme. To get to know if your business is eligible and if you can qualify for RLS, please consider the table below:

| Eligible Businesses | Non-Eligible Businesses |

|

|

If you are interested in applying for a recovery loan scheme with 247businessfinance, contact us at 0800-061-4919 and we will guide you through and will help you get the loan amount at its earliest. Otherwise, we have also summed up a very convenient procedure that will guide you on how to apply for a recovery loan scheme.

How to Apply for Recovery Loan Scheme?

Step 1: Approach a lender directly from their websites or Choose RLS accredited lenders.

Step 2: The lender will need the following information to process your application. Such as;

- Management accounts

- Business plan

- Historic accounts

- Details of assets

- Details of previous subsidy awards

Step 3: After accessing all the information, the lender will make a decision. If a lender can offer a commercial facility on better terms than an RLS-backed facility, they will do so. If that is not the case, and you are eligible for support under the scheme, a lender may use RLS to help offer you the finance you need.

Step 4: Decision-making on whether a business is eligible for RLS is fully delegated to the British Business Bank’s accredited RLS lenders.

Step 5: Once a lender makes a decision then you can have your loan amount to grow your business.

Instead of finding a lender by yourself, contact us and we will do the overwork for you. Get a FREE Quote here or email us at [email protected]

Points to Ponder |

Lenders are allowed to take personal guarantees for facilities of all sizes if taking a personal guarantee is part of their typical lending practice. Lenders cannot take your principal private residence as security.

A lender can claim 70% of this loss (£280,000) under the guarantee, leaving £120,000 as the final loss to the lender. |